Chinese banking institutions have never had it so good. Listed banks posted glowing interim reports recently, with the Industrial and Commercial Bank of China emerging as the world's most profitable lender and China CITIC Bank posting a phenomenal 160 percent rise in profits.

Increasing income from interest, bigger fee-based revenue and a tax rate cut propelled a highly satisfactory growth in the first half.

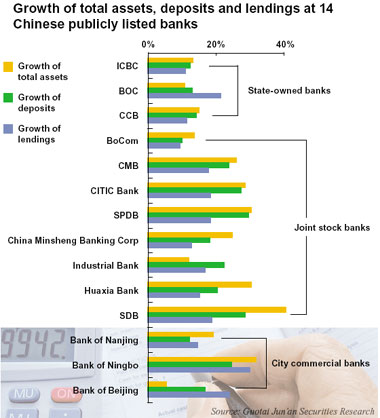

The 14 publicly traded banks recorded a combined net profit of 232.72 billion yuan (US$34.1 billion) with an average profit of 16.62 billion yuan in the first half.

"The average profit growth is better than what we expected," said Zhang Yan, a Datong Securities Co analyst.

Experts from Guotai Jun'an Securities Co were equally upbeat. The average profit growth of 64.38 percent was higher than their previous estimates of 60.6 percent, the securities firm said in a research report.

The growth of interest-generating assets and widening interest rate spread led to the swift rise in banks' profits, Zhang said.

Monetary policies

For instance, ICBC, the world's largest bank in terms of market value, reported an interest income of 131.79 billion yuan in the first half, up 29 percent from a year ago. The bank recorded the highest interest income among the 14 listed banks.

The People's Bank of China introduced tight monetary policies this year by limiting banking quotas. Limited lending resources meant banks had more flexibility in increasing interest rates.

As a result, six interest rate hikes were announced in 2007, which helped shore up the banks' margins in the first half.

Except the Bank of China, which lagged behind due to its US subprime mortgage exposure, the other 13 listed Chinese banks all posted increasing interest margins.

Among them, Shenzhen-based China Merchants Bank reported the biggest increase margin of 3.66 percent. The Bank of China, the country's biggest foreign exchange lender, posted the smallest margin of 2.85 percent.

Guotai Jun'an Securities said the lower bank provision against possible bad loans contributed to the healthy figures. The combined profit growth before provision sat at 42 percent in the first half, down from 46.22 percent in 2007. In anticipation of some borrowers' defaulting, banks usually set aside part of their earnings through an expense account called the provision for loan losses. The lower this amount, the greater is the bank's profit.

However, analysts are not sure whether banks can continue to sustain such high profit rates. They fear that the second half may not bring an equally glossy report card. Bankers too are treading cautiously as they realize the immense challenges of turning in rosy reports year after year.

Pang Xiusheng, chief finance officer of China Construction Bank, said the bank's first-half profit growth is already very high and it may not be possible to sustain such a rapid growth in the next two years.

The Beijing-based bank's net profits rose 71.3 percent to 58.69 billion yuan from January to June. The bank, which is the country's second biggest commercial lender by assets, said increasing economic uncertainty may bring down their growth.

Jiang Chaoliang, chairman of the Bank of Communications, held similar views, noting that the bank's profits in the first half have reached a peak. The tax rate-cut policy introduced in 2007 was a one-off case and won't be repeated in the years to come, said Jiang.

China cut corporate income tax rate from 33 percent to 25 percent this year for domestic and overseas companies. This helped the banking sector increase its profit margins too.

"The second-half profit growth is set to decline due to shrinking interest margin and potential for higher exposure to bad loans," Datong's Zhang added.

The slowdown of the economy and weakening of the property sector are adding to the banks' bad loan burden.

The Chinese corporate sector is facing sliding profits amid a slowdown of the economy. Banks also face added lending costs. Due to a sluggish capital and property market, banks are being saddled with more deposits. Analysts said deposits also grew in the first seven months due to a falling stock market.

More money is expected to flow back to banks in the near future with no sign of major rebound in the investment markets, analysts said.

The benchmark Shanghai Composite Index has plunged continuously this year, driving lots of investors out of the market and toward the banks.

Total deposits at all financial institutions grew to 45.53 trillion yuan at the end of July, up 18.79 percent from a year ago. Outstanding yuan deposits rose to 44.37 trillion yuan at the end of July, up 19.6 percent.

In July, yuan deposits added 468.2 billion yuan, up 309.7 billion yuan from last year.

Chinese banks have higher return on assets when compared with counterparts in major developed countries due to the higher interest spread and lower cost, said Wu Songkai, a United Securities Co analyst.

However, analysts say, in the long run, profit figures will return to a more reasonable level.

(Shanghai Daily September 8, 2008)