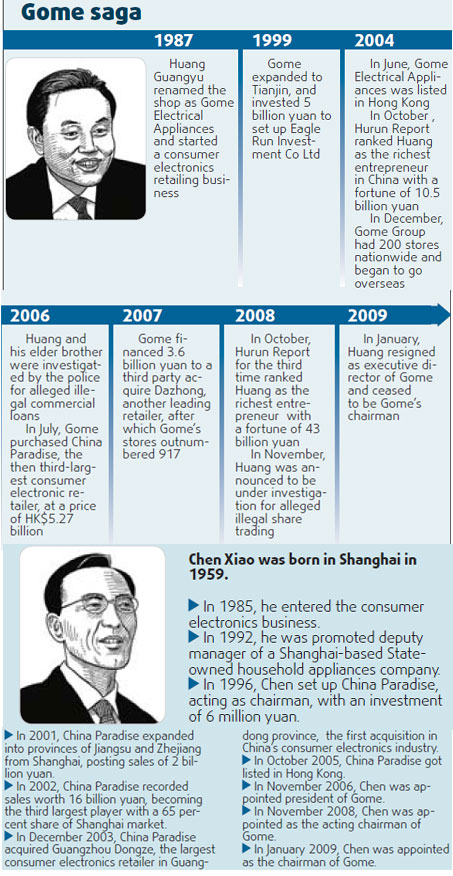

Chen Xiao came to Gome as nothing more than one of the many senior executives in November 2006 after his company, Paradise, of which he was chairman, was gobbled up by his new employer, Huang Guangyu.

Both men were prominent players in the fiercely competitive consumer electronics market of China, but their personalities and business philosophies are poles apart. The reserved and mild-mannered Chen, a tall and lean-looking native of Shanghai, stands in sharp contrast to the flamboyant and pudgy Huang, who exemplifies the take-no-prisoner business style of a Chaoshan entrepreneur.

Nobody had expected Chen to last more than a few months in the go-go corporate culture of Gome.

But, in what has been widely seen as a dramatic twist of fate, Chen has taken the helm at one of China's largest and best known big-box retail chains in January from its now deposed chairman, who is known to be assisting the Beijing police in an investigation of irregular share trading involving a number of listed companies.

The unassuming 50-year-old Chen, with a limp from a bout of polio during childhood, now finds himself occupying the top slot at a time when the company is facing its toughest challenge since its founding by Huang and his close associates in 1987. Huang's alleged involvement in the share scandal late last year has thrown Gome into disarray, and the company's shares have been suspended from trading on the Hong Kong stock exchange.

Gome is now facing a real threat of its finances drying up as bankers become cautious on new lending. To make matters worse, the beleaguered company also had to contend with an all-out suppliers' revolt. Under Huang's leadership, Gome was known for being tough on its suppliers, squeezing their margins and extending payment periods. Now, the suppliers are obviously hitting back when the chips are down.

Gome's problems have also been magnified by the downturn in demand for big-ticket electrical appliances as the Chinese economy starts feeling the impact of the global recession.

Softening demand has, in turn, brought to the forefront Gome's past excesses. In an almost single-minded pursuit of market share, the company had neglected issues like customer service and store profitability.

"Many of Gome's stores are in bad locations with lackluster in-store displays and depressing service," said Wu Meiping, analyst, Essence Securities.

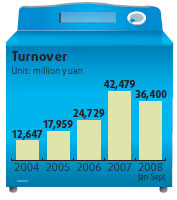

Despite its scale, Gome actually trails its arch rival Suning in terms of profitability and per store sales. During the first three quarters of 2008, Gome posted a 45.31 percent increase in profit from a year earlier period to 1.87 billion yuan. Sales during the period rose 20.04 percent to 36.4 billion yuan. In comparison, Suning's profit in the same period rose 65.03 percent to 1.71 billion yuan, while sales grew 40 percent to 39.1 billion yuan.

Suning's gross profit ratio was 16.3 percent, or 0.7 percentage points higher than Gome and its ratio of store rental to sales was 3 compared to Gome's 4.1.

Gome's share price nosedived to HKUS$1.12 on Nov 21, 2008, before the trading suspension, from a high of HKUS$21 in 2007 when it posted a profit of 1.17 billion yuan and revenue of 42.48 billion yuan.

Few, if any, of Gome's senior executives, nurtured during the boom time under Huang, have the knowledge and skill needed to steer the company's ship out of troubled waters. More important, none of them has the stature and experience in the industry to command the respect and trust of the suppliers and bankers. Chen was the company's only choice for a leader.

"He (Chen) was certainly the man of the moment," said Li Su, president of H&J Vanguard Research and Consultant, a market research company. "Chen seems to be the only one who has the experience in sales strategies required to combat Shanghai-style competitors like Suning and is more qualified to lead the company than Huang," Li said.

Chen declined to be interviewed for this story. His lieutenants said he has never given an interview to any publication. "It's not his style," said He Yangqing, Gome's vice-president for corporate affairs.

Chen declined to be interviewed for this story. His lieutenants said he has never given an interview to any publication. "It's not his style," said He Yangqing, Gome's vice-president for corporate affairs.

But Gome's senior executives interviewed by China Daily said Chen is quietly reshaping the company to maintain its pre-eminent position in China's retail sector. The immediate challenge for Chen, however, is to lift the sagging morale of employees at the headquarters as well as its stores and to establish cordial relationships with suppliers. He will also have to set up new lines of credit to steer the company back into the black.

Among his peers in the retail industry, Chen is known to be methodical, while to his detractors, he is a boring manager who has followed the same routine throughout his career. At Gome, he usually comes to work every day at 9 am. After meetings with close aides and visiting business associates, he settles down with paper work until 7 pm. He is also known to be an avid reader of news.

Chen has kept a low profile since his new appointment, only saying in a written reply to media questions: "I take (my new job) seriously. We will be taking positive measures and will try to manage the company in a more transparent and responsible way."

His friends said his apparent shyness belies the open mindedness to change. "Chen may look scholarly and dull, but he is actually very quick of mind and appreciates innovative ideas," said a long-time acquaintance Han Jianhua, secretary-general, Shanghai Household Appliances Association. "He is definitely not the stubborn traditionalist that his stern look may suggest."

Shortly after he took over the chairmanship, Chen tried to cultivate a softer corporate culture that was distinctly different from the patriarchal autocracy of his predecessor. "He (Chen) is amiable," said Cai Xu, manager of Gome's newly established 3C Business Center. "He makes you think you're really getting involved in the decision-making process because he always tries to listen carefully to what you have to say before making up his mind," Cai said.

A relatively junior staff at the company's administrative department said that he was "very excited" when he received a New Year letter signed by the new chairman. He declined to be quoted.

"The content of the letter is really not all that important compared to its symbolic meaning," the administrative officer said. "It makes us feel that the company actually cares about our personal interests," he said.

"The content of the letter is really not all that important compared to its symbolic meaning," the administrative officer said. "It makes us feel that the company actually cares about our personal interests," he said.

Calming the nerves of the suppliers seem to be a much more daunting task for Chen. For years, Gome was famous for leveraging its vast sales network to squeeze profit margins of suppliers not only by demanding lower prices, but also by extending the payment period from the industry norm of 30 days to three months.

Now, the tables have been turned and the suppliers are demanding better terms from the company. And Chen is responding.

Entering the retail business in 1985, Chen made Paradise, set up with an initial investment of 6 million yuan in 1997, the third largest consumer electronics retailer with annual sales of 16 billion yuan in 2002 before it was taken over by Gome. The secret of his success lies partly in his personal skill in garnering the support of suppliers, especially when the company was still small.

Gome's executives conceded that Chen's personal relationship with suppliers had averted a revolt that could have completely paralyzed it in the early days of the crisis. Since then, he and his aides have continued to improve relationships with suppliers.

"In the past, we simply dictated our terms to the suppliers," said He. The threat of shutting them out from Gome's stores was enough to make them comply, he pointed out. Now, "we discuss with our suppliers on how Gome can help to maximize their profits," said He.

According to He, Gome has agreed to make faster payments to suppliers for goods sold and is trying to work closely with them on product development by sharing the information of consumer needs based on feedback from its stores. "We also cooperate with our suppliers to directly promote their new products on all those who visit Gome stores," He said.

Funding is another issue that Chen must address urgently as bank borrowings are becoming less forthcoming, stock analysts said. The company has between 940 million yuan and 3.4 billion yuan of short-term liabilities, according to a Nomura report. It also has convertible bonds of 4.6 billion yuan that need to be repaid in 2010, the report said.

The company is reportedly preparing for a bond issue in Hong Kong to help reduce debt. Gome has said that the task on hand was to complete the audit of the company's accounts and to ascertain that the company's finance is separate and independent of its former chairman's personal endeavors.

The company is reportedly preparing for a bond issue in Hong Kong to help reduce debt. Gome has said that the task on hand was to complete the audit of the company's accounts and to ascertain that the company's finance is separate and independent of its former chairman's personal endeavors.

Industry experts and stock analysts agree that Chen's real imprint will be seen on Gome's make-over strategy.

He said: "In 2009, Gome will focus on increasing sales in each store instead of opening more stores."

The company, He said, will try to keep the same number of stores it now has. It will open new stores only after underperforming stores in undesirable locations are closed.

Meanwhile, the new management of the company is also taking steps to improve the in-store environment to entice shoppers. At the urging of Chen, a 60-member research team has been set up to advice management on store locations, in-store product display, product mix, consumer trends and purchasing requirements.

In addition, the company has also streamlined its operations into three major divisions: traditional consumer electronics, computer products and small electrical appliances.

By the end of 2007, Gome had a total of 41 telecommunications stores. But it was seen to be far from enough. In mature markets, sales from 3C goods typically account for over 50 percent of the total of a normal-sized consumer electronics store. The ratio for Gome was less than 20 percent in 2007.

The emphasis on small appliances was also profit-driven. Compared with traditional consumer electronics, small appliances yield higher profit margin at an average of 20 percent, while it is 10 percent for air-conditioners and 5 percent for television sets.

There are compelling reasons for Gome to change its strategy. While the total store area has grown rapidly, the average profit per sq m in Gome stores had dropped from 1,800 yuan in 2004 to 442 yuan in 2007.

"Because the capital of Gome is not as adequate as in the past, it would be a sound strategy to improve the profitability of the existing stores rather than increasing market share on the mainland market," said Linus Yip, a strategist at First Shanghai Securities.

Li of Vanguard praised the new management for helping to "ameliorate the company's relationship with suppliers and maintain its strategy of focusing on first-tier cities. He also lauded Chen's steps to strengthen the management team, reduce infighting and focus on competing with rivals like Suning.

Despite the accolades, Chen has yet to win the full confidence of investors and financiers, stock analysts said. The shares of the company are still rated as "risky" and have "sell" ratings by many Hong Kong brokerages. "As long as Gome's management succeeds in stabilizing the company's operation and with the absence of any surprise in future audit reports, it would be reasonable to expect banks to gradually ease on Gome," said Sandy Chen, analyst, Citigroup Hong Kong.

(China Daily February 17, 2009)