The overall situation concerning budget implementation and financial operations in 2007 is as follows:

1. National revenue grew rapidly.

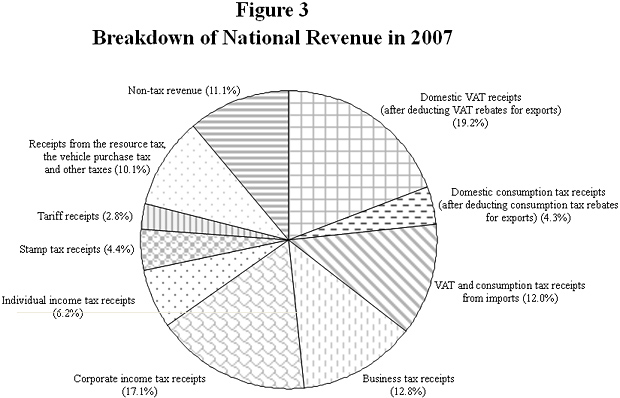

The national economy maintained rapid yet steady development in 2007. Based on this, financial, tax, and customs authorities at all levels worked hard to administer taxes in accordance with the law, made management more scientific and meticulous, improved the quality and efficiency of tax revenue collection and management, and standardized the management of non-tax income. All this resulted in the rapid growth of national revenue. Specifically: Domestic value added tax (VAT) receipts totaled 1.547011 trillion yuan, up 21 percent and equaling 108.5 percent of the budgeted figure. Domestic consumption tax receipts stood at 220.69 billion yuan, up 17 percent and equaling 107.4 percent of the budgeted figure. VAT and consumption tax receipts from imports totaled 615.221 billion yuan, up 24 percent and equaling 109.3 percent of the budgeted figure. VAT and consumption tax rebates for exports came to 563.5 billion yuan, up 15.5 percent and equaling 115.5 percent of the budgeted figure, and this was equivalent to a decrease in revenue by the same amount. Business tax receipts reached 658.199 billion yuan, up 28.3 percent and equaling 113.6 percent of the budgeted figure. Corporate income tax receipts grew by 37.9 percent to reach 876.947 billion yuan, equaling 120.2 percent of the budgeted figure. Individual income tax receipts rose by 29.8 percent to reach 318.554 billion yuan, equaling 110.8 percent of the budgeted figure. Stamp tax receipts amounted to 226.176 billion yuan, an increase of 500.5 percent and equaling 545 percent of the budgeted figure. Tariff receipts totaled 143.254 billion yuan, up 25.5 percent and equaling 114.6 percent of the budgeted figure. Non-tax revenue stood at 569.104 billion yuan, up 22.8 percent and equaling 111.2 percent of the budgeted figure.

It should be noted that the rapid increase in national revenue was mainly a result of rapid yet steady economic development, improved economic structure and efficiency, and strengthened revenue collection and management. There were also unique, policy-related and one-time factors that contributed to the increase. These factors mainly include the following: First, the increases in transactions on the securities market and in the stamp tax rate on securities transactions increased tax revenue by 182.585 billion yuan. Second, tax rebates were reduced by 40 billion yuan due to policy changes, and this was equivalent to an increase in revenue by the same amount. Third, railway transportation enterprises turned over to the central government 19.6 billion yuan from the proceeds of their sale of state assets, and that was a one-time only source of revenue. Fourth, special surcharges on oil sales for the whole year totaled 50.14 billion yuan, an increase of 12.937 billon yuan over 2006 when they were collected for only two quarters.

National revenue exceeded the budget target by 723.9 billion yuan, including a 416.8 billion yuan excess in the central budget. The main reasons for this are as follows. The actual economic growth rate exceeded the target rate. In particular the actual growth in areas that generate tax revenue, including added value of industry and commerce, total fixed asset investment, total volume of imports and exports, total retail sales of commodities, and corporate profits all exceeded the projected figures by a large margin, so the actual tax revenue they generated exceeded the budgeted figures. In implementing the budget, the government introduced new policies for strengthening macroeconomic regulation, such as adjustments of the stamp tax on securities transactions and the policy on export tax rebates, and they also contributed to the revenue increase. In addition, tax collection and management were strengthened, resulting in the collection of a higher proportion of taxes owed.

The surplus revenue in the central budget in 2007, except that portion used to finance additional expenditures required by law, was mainly used in important areas concerning people's lives and for establishing systems and mechanisms in accordance with the Budget Law of the People's Republic of China, the Law on Oversight by the Standing Committees of People's Congresses at All Levels of the People's Republic of China, the Decision of the NPC Standing Committee on Improving Examination and Oversight of the Central Budget, and relevant resolutions and decisions of the Fifth Session of the Tenth NPC, as well as on the basis of comments and suggestions from the Law Enforcement Inspection Group of the NPC Standing Committee, relevant special committees of the NPC and deputies to the NPC.

First, 101.4 billion yuan was spent in compliance with the requirements of the existing financial system and regulations. Of this sum, 66.7 billion yuan was spent to increase tax rebates and general transfer payments to local governments. The surplus revenue of 11.7 billion yuan from the vehicle purchase tax was all spent on road construction, including the maintenance and repair of dilapidated bridges. All the 19.6 billion yuan that railway transportation enterprises received from the sale of their state assets and turned over to the central government was spent on railway construction. In addition, 2.9 billion yuan was spent on science and technology.

Second, 143.7 billion yuan was spent to improve people's lives and strengthen weak links. Of this sum, 16.1 billion yuan went to agriculture, forestry and water conservancy; 21 billion yuan to education; 34.4 billion yuan to the social safety net and employment effort; 31.3 billion yuan to medical and health care; 19.6 billion yuan to environmental protection; 4.8 billion yuan to low-rent housing subsidies; 13.3 billion yuan to public security and general public services; and 1.1 billion yuan to culture.

Third, 171.7 billion yuan was spent to make public finance and economic activities more stable and sustainable. This breaks down as follows: 45 billion yuan was spent to reduce the budget deficit; 23.5 billion yuan went to clearing up historical debts arising from grain policies; and the other 103.2 billion yuan was spent to increase the central budget stability and regulation fund. The State Council has reported its use of the surplus to the Standing Committee of the Tenth NPC.