What should we expect from recent China-US currency talks?

According to much of the media, the recent trip by the US Treasury Secretary, Timothy Geithner, to China on April 8, to meet with top Chinese leaders (including Vice Premier Wang Qishan), to discuss many bilateral and international economic issues, focused on past, present and future RMB-USD exchange rates. From these reports, the casual observer may have the impression, that at best, the Chinese have merely "pegged" their currency at an artificially low level to support their vast array of international exports, or at worst, the Chinese are guilty of nefariously manipulating their currency in order to gain some unspecified advantage.

Of course, there is much more to these simplistic explanations than meets the eye. But before being able to get a better idea about what is actually going on, we must lay some groundwork.

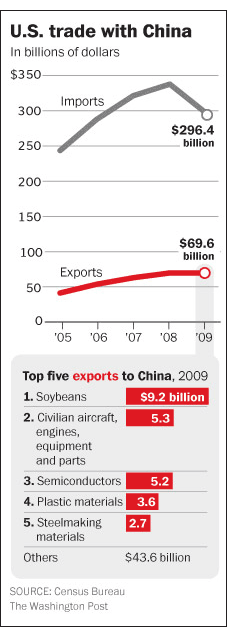

There is no question that China exports to the U.S. more than she imports from the U.S. This gap is huge; however, US sales to China are not trivial. (Please see the accompanying graph.)

Furthermore, exports from China to the U.S. have been dramatically reduced; primarily due to the financial and economic downturn in the U.S. This reduced level of imports is consistent with the notion that Americans must learn to consume less and to produce more, if they are to ever get their economic house in order. However, despite the world-wide downturn, US exports to China slowly increased over the same period. Consequently, it can be argued, the trade deficit between China and the U.S. is narrowing, even with the recent past and present exchange rates.

In addition, relatively cheap Chinese imports have been very good for the American consumer. These imports have found their way into almost every aspect of everyday life in the U.S. and they have contributed greatly to our current standard of living.

When Americans buy Chinese products, they pay for them with vast amounts of US dollars, which the Chinese readily accept. If this were the end of the story, the existence of relatively plentiful US dollars would put great pressure on the RMB to strengthen against the US dollar and, in all likelihood, there would be little the Chinese government could do about it and, for that matter, any other government or central bank as well.

However, it is not the end of the story. The Chinese have many uses for US dollars. China imports about half of its oil needs. But, perhaps more importantly, it is not in China's best interest to keep large sums of idle American dollars collecting no returns. Consequently, China became the largest holder of US Treasury (UST) securities in September 2008. After that, China increased its buying of UST debt; due in large part to its desire to convert much of its huge foreign exchange reserves (currently estimated to be $2.4 trillion) into tangible assets. Chinese holdings of UST securities peaked at about $801 billion in May 2009. It is important to note, Hong Kong possesses approximately $146 billion of UST securities which are not included in the total for the Chinese mainland. If Hong Kong and the Chinese mainland totals were combined, the grand total would now be approximately $901 billion.

The US consumer pays China for its goods and the Chinese lend these same dollars back to the US government, which desperately needs them to finance its multitude of enormously expensive programs related to the economic recovery, the recently passed health care legislation and military spending. Therefore, it is this two-way flow that has more or less kept the RMB-USD exchange rate relatively stable during the past two or three years. It can be argued that the Chinese can manage the exchange rate indirectly by managing their buying and selling of UST debt. In fact, China did reduce its holdings in UST securities by about $34 billion during December 2009 by simply allowing many of its US securities to mature without a one-for-one reinvestment in similar securities.

In conclusion, the Chinese government needs a dependable place to park its huge foreign exchange reserves and the U.S. is still a reasonable location for doing just that. The US dollar remains a reliable international currency for the Chinese because of the US's steadfast legal system, sophisticated capital markets and political stability. China's holding of US government debt is probably one of the most significant mutually beneficial engagements between China and the U.S. Therefore, it is unlikely that either side is willing to deviate too far from behaviors of the past. If this line of reasoning holds, we can expect only minor changes in the RMB-USD exchange rate well into the foreseeable future.

Dr. Claggett is a columnist with China.org.cn. For more information please visit:

http://m.by33321.com/opinion/node_7078635.htm

0

0